Attorney Books: Using No Status

One of the things I love about collaborating with other accountants and bookkeepers is learning new trade tricks.

The last few weeks have been narrowly focused on how to clean up your client files. This week is also similar as one of the final steps in the cleanup is showing the client any uncleared transactions as we finalize the year's records.

In the past, as I was going through each checking account, I would screenshot for my client the uncleared transactions by going into the reconciliation screen under a future date.

Bonus Tip

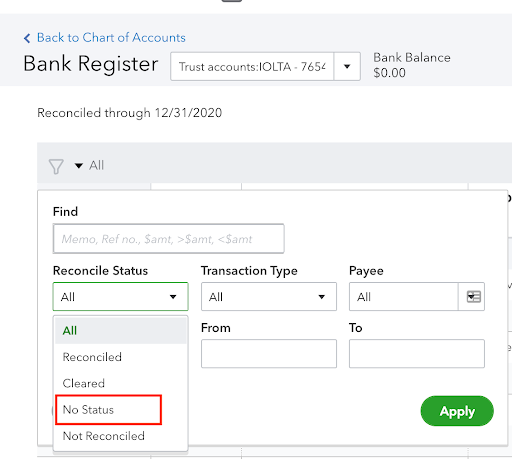

But when working with my business partner, Sarah, she showed me a new trick! Did you know there's a filter on the left-hand side when you enter a check register in QuickBooks? It's a filter we use to search for missing items or perhaps in the wrong bank account. Uncleared transactions often happen when attorneys do their bookkeeping or when you work with an admin who does the same and doesn't know how QuickBooks works.

There is also a filter called "no status." You are filtering for any check or deposit that hasn't cleared the bank (nope, you should be reconciling all your bank accounts first). What causes checks or deposits not to clear? Year-end is a great time to clean these items up.

Uncleared checks/payments

The client didn't send it (Yes, in working with the admin, I was told, "it's still sitting here on my desk.") Of course, my next question is why?

The check is mailed, but the law firm's client never cashed it. Lost checks happen a lot with trust accounting. Especially if the amount is minimal, the law firm client will tend not to cash it, or the check is lost.

Uncleared deposits

For deposits not entered, it may be a different story. There should be no hanging deposits if you've been reconciling regularly. I see this a lot when working with immigration firms with cash deposits. They may gather them together to make a deposit, but that never gets to the bank. I even had one client use the money for petty cash.

There can be various other reasons why deposits are not deposited. They should always be deposited and cleared by the bank.

Many times I see credit card payments hang. Hanging credit card payments are caused when the transactions are downloaded from the bank feed and entered as credit card payments. They are entered twice. It's a messy transaction to clean up. We instruct all our staff not to use transfers when doing client bookkeeping.

So as you can see, using the "no status" button is a highly effective technique for producing a report for your client to show them anything that has not cleared their bank account.

Trust account open balances on closed matters

We handle this workflow process annually for our law firm clients. It's a highly affected method and cleaning up small trust account client balances. How often have you taken on a client and found that they have a balance left over for like one penny? It's a good practice to clean up the small older valances by either issuing a new check or sending them to the state's unclaimed money account.

I hope this article was helpful and taught you a new trick! Be sure to like and follow the video and subscribe to follow us weekly for more law firm accounting tips. If you are an attorney with messy accounting records or your bookkeeper, just quit, call us. Books cleanup is a service that we provide. Call today!