What you need to know about payroll when working with attorneys & law firms

Do you work with attorneys? What is the differences in working with law firms and payroll? The short answer is not much. But it all comes down to the entity. Are they a PC? LLC? Inc? That makes a difference in payroll. Do the partners take distributions and pay them to an outside company? Yes, that is a "thing" we see all the time. The outside company may be an S Corp so the attorney can capture that payroll. But in the company file you are working in, they are taking a distribution. Are you confused now? I know, it can be confusing.

To explain it well, here is the typical ways we see people get paid when they work at a law firm.

Types of pay you will see:

Gross salaries, wages, bonuses, commissions, and overtime pay

Payroll taxes withheld from employees' gross pay

Payroll taxes that are not withheld from employees and are an expense of the employer

*Note: on any wages over $200k there is a Medicare surtax of 0.9% (which is also known as the Additional Medicare Tax) that is withheld from the employee on wages and salaries that are over that threshold in a calendar year. However, this Additional Medicare Tax is not matched by the employer. See IRS Publication 15, Employer's Tax Guide for more information on this additional tax.

Employer-paid time off for holidays, vacations, and sick days

Other employer expenses including workers compensation, medical insurance, and others

Salaries and Wages

Salaries are usually associated with "white-collar" workers such as office employees, managers, professionals, and executives. You will see partners pay the attorneys and paralegals this way (typically).

Can there be overtime for a salaried person? Yes.

Overtime Pay for a Salaried Person: While it is rare, it does happen. Let's assume that an office clerk receives an annual salary of $18,000 per year and is expected to work 40 hours per week.

Scenario: During a recent workweek the clerk was required to work an additional 4 hours. This person's salary and responsibilities require the employer to pay overtime at the rate of time-and-a-half for the additional 4 hours.

The overtime pay calculation is as follows:

The straight-time hourly rate for the annual salary of $18,000 is: $18,000 divided

by 2,080 hours (40 hours in workweek X 52 weeks) = $8.65 per hour

The overtime premium (which is half of the straight-time hourly rate) is: $8.65 times 50% = $4.33 per hour

The time-and-a-half rate is: $8.65 + $4.33 = $12.98 for each overtime hour

Assuming the clerk is paid semi-monthly, the clerk's next Paycheck will consist of the following: Regular salary amount of $750.00 ($18,000 divided by 24 semi-monthly pay periods per year)

Overtime pay is: 4 overtime hours X $12.98 (from above) = $51.92

Office clerk's pay for the semi-monthly period = regular salary of $750.00 + overtime pay of $51.92 = $801.92

Wages are often associated with production employees (admin staff, runners, for example), non-managers, and other employees whose pay is dependent on hours worked. The pay for these employees is generally stated as a gross, hourly rate, such as $15.32/ hour.

Employees must be paid a minimum wage for all hours worked. FSLA link

Payroll Withholdings: Tax and benefits

Many state income tax systems require employers to withhold payroll taxes from their employees' gross salaries, wages, bonuses, etc. The withholding of taxes and other deductions from employees' Paycheck affects the employer in several ways:

- Some are deducted from an employee’s Paycheck

- The employer must record a current liability in its accounting records for the amount withheld-see payroll spreadsheet

- The employer must remit the withheld amounts by the required dates

Employer Responsibility:

Failure to remit the payroll taxes by their due dates can result in severe penalties.

The withholdings from an employee's gross pay include:

- Employee portion of Social Security tax

- Employee portion of Medicare tax

- Federal income tax

- State income tax

- Court-ordered withholdings

- Other withholdings

Employee Taxes/Employer Matching:

In 2021, the amount of Social Security tax that an employer must withhold from an employee is 6.2% of the first $137,700 of the employee's annual wages and salary; any amount above $137,700 is not subject to Social Security tax withholdings. The $137,700 is referred to as the Social Security wage base, wage limit, ceiling, or maximum taxable earnings. See Publication 15-T for more details

Sole Proprietors, LLC’s and Partners:

A sole proprietor is the owner of a business organized as a sole proprietorship and is not considered to be either an employee or an independent contractor. Similarly, partners of a business partnership are neither employees of the business or independent contractors.

They can have a payroll for their staff however, the payments to themselves are considered distributions or draws.

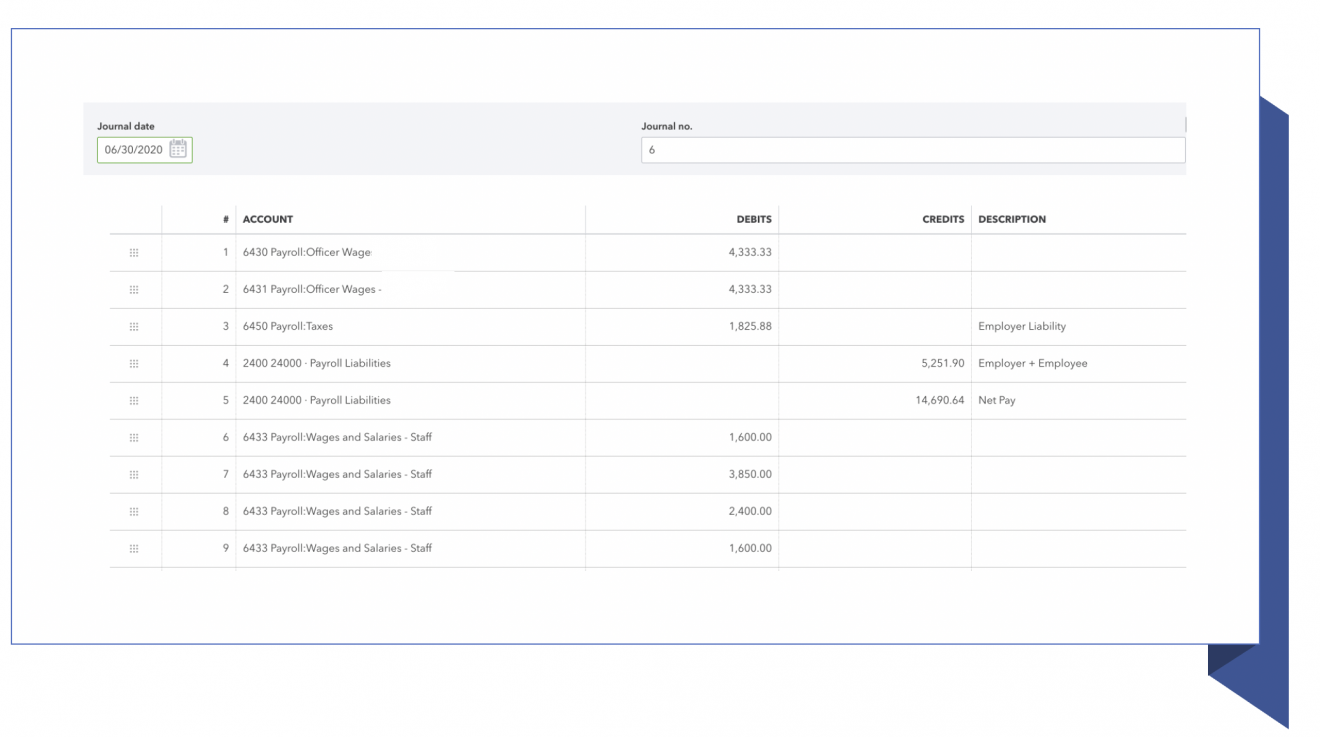

Sample Journal Entry:

Gusto: Become a partner ~ get commission. This is a recurring rev share

QuickBooks Online: Partner with a reseller: One-time commission payment or Wholesale billing

Are you a bookkeeper or accountant new to working with attorneys? We have a private group for you! Have you heard about our new group, The Accountant’s Law Lab? Join us today!

Are you an attorney looking for help with your accounting needs? Do you need assistance with becoming future-ready and moving to cloud-based accounting systems? Call us!