Attorney Books Comparison Reports

What processes are best for the year-end cleanup of your books? We already reviewed using the books review feature in QuickBooks, which is a great start. This is a task I perform on client files, typically quarterly or monthly. But it is very important to give the records a good look through at year-end.

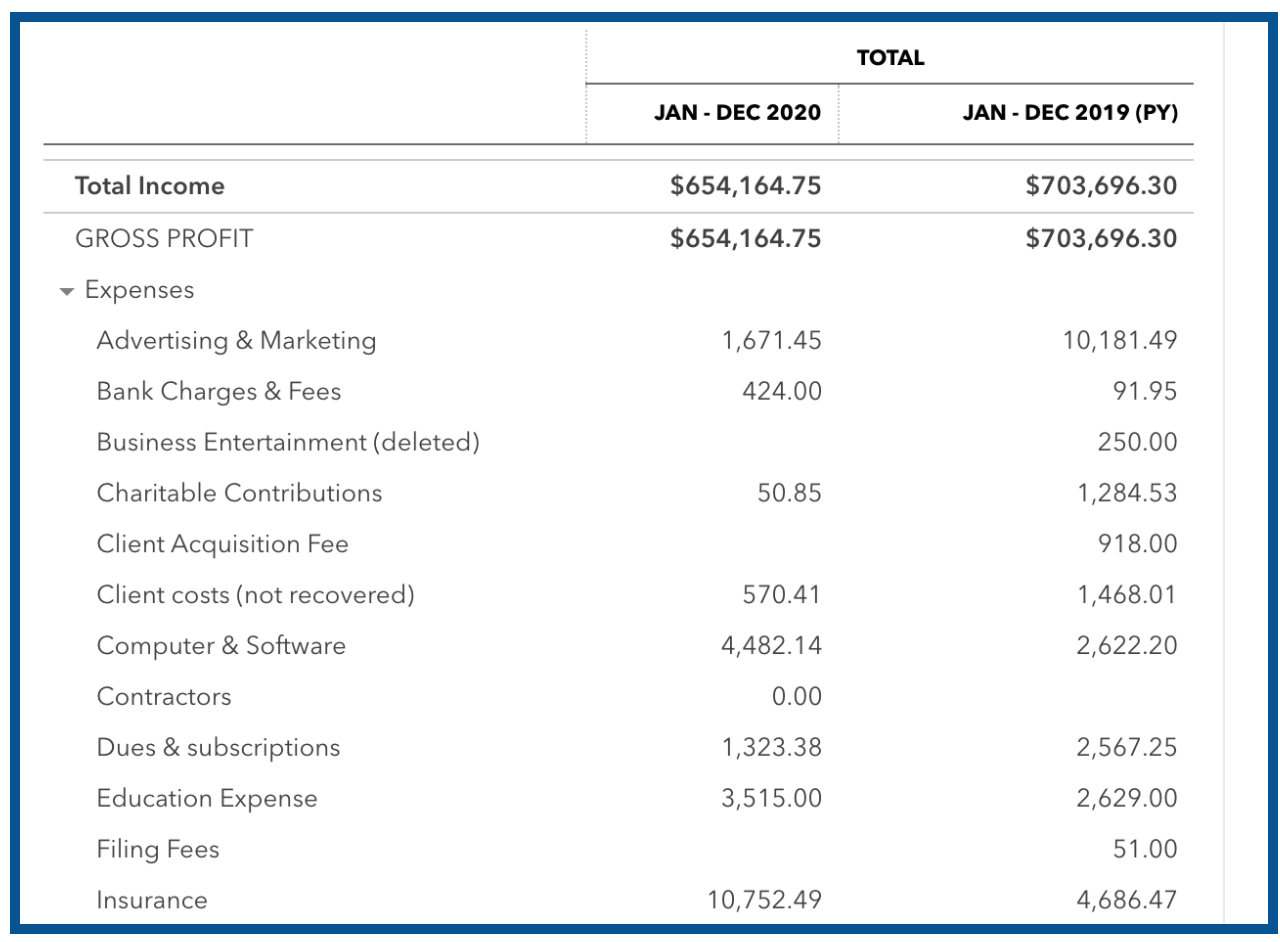

Comparing your records from last year to the equivalent prior tax period will not only help you to ensure your data is correctly assigned and categorized, but it can also help you know where you stand with your business regarding firm growth.

Comparison reports show your totals year-over-year and reveal trends across different aspects of your financials and how they fluctuate when it comes down to increases or decreases in revenue depending on factors like the economic climate, changes in consumer habits, or growth in specific areas that are directly or indirectly related to your industry sector as a whole such as consumer preferences, clientele, number of employees, etc.

Balance Sheet comparison report

Look at this report with a lens of how you are doing. Did you purchase any new assets? Retire any old ones? These are things you need to look at. Additionally, you will want to add some receipts to the asset purchases and details of what was purchased to aid the CPA in calculating the depreciation at year-end.

Looking at credit card balances and comparing those from last year to this year. Are your balances higher at year-end 2021? It is a great way to see the "health" of a business. If you have a lot of debt on the books, maybe it is time to start to think about or implement a plan to pay it down.

P&L comparison report

Looking at this report is where you can get into the nitty-gritty of thinking ahead.

What is my sales goal for 2021? Maybe create a budget with a goal. I like to think big here. Remember, however, that increasing sales without considering where you can decrease expenditures is foolish. When analyzing the data, you need to be thinking about where you can also reduce costs. Run leaner. This comparable report is great for just making sure things are in the right place first and then looking more deeply as to where you would like to be at the end of 2022.

This was the last of the Year-End processes. But it really is just the beginning. I highly recommend reviewing, analyzing the data, and creating a budget for 2022. Really look for places where you can cut costs. Look for ways to get more quality clients. Analyze your leads and those that became clients vs. those that did not. Analyze the data by practice area. Both of these two processes will help your business flourish. You may also want to see what your competitors are doing. Reach out/collaborate.

If you take the action steps outlined above, you can make some smart decisions on your firm's trajectory or if you are the accounting expert, help your client make smart financial decisions.

Stay tuned for some cool QuickBooks tips in the next article. We hope you enjoyed this article about using a balance sheet as an important tool in financial analysis. You can use the balance sheet to compare prior periods with this knowledge. So what are you waiting for? Get started strategizing your books or your client’s records today!