Law Firm Budgeting

Budgeting? Do I need to create a budget for my law firm? So many things to do; is this essential to running my law firm?

This discussion is half the conversation I hear when I bring up the topic of budgeting. Some clients are all in, and they really want to get organized and stick to a budget. For other clients, the word budget might have some negative connotation to it.

But if the business is fluid with cash, do we need a budget? As I mentioned in the earlier post, I’m getting ready for 2021; yes, this is the time you need a budget. It’s that old saying, saving for a rainy day fund. We don’t know when the rainy day is going to come, but it always comes. Why not be prepared? I’d like to see 90-days of funds in a savings account or if the income completely stopped.

So let’s replace that scary word, "budget" and call it a financial strategy. I learned this tip from the Lawyerist Podcast, my all time favorite law firm podcast that Ihad the good fortune to be on -- Thank you Intuit! When you use this direct financial approach and language, typically, the lawyers are "all in" on this vital component of mapping out their future.

Now I may have your attention, are you excited about this?

How do we start? The easiest place to start is with your past. You are looking at the historical data. Seeing where you spent your money and we are, maybe you can trim the fat. Add the percentage columns to analyze what percentage the expense is towards the income or the overall cost involved. But this is not all about the past. Remember this is about the future of the firm. As a specialist in working only with attorneys (Yeah Niche), I can see where to help my clients because I have so many records I can review. I see what works and what is a waste of time. In addition, absorb all of these podcasts, attorney webinars, etc. Some of my favs besides the Lawyerist are the blogs by Cosmolex, anything by the American Bar Association, the Legal Toolkit, and Technically Legal.

Places to focus are as follows:

Wages or attorney wages:

This is typically the most significant expense in the firm. Are you paying overtime? Do you need to hire maybe a part-time person who would be more beneficial in cost savings?

Apps:

I am the first to admit, I like to investigate new technology. What did you spend on them? Are you still using them? Do you need to eliminate some that may be recurring?

Fixed expenses:

Is there a way to reduce these? Examples of this would be insurance.

Meals/staff meals/travel:

Some of these took a hit this year due to Covid. Now you can sit back and analyze multiple years and decide how effective they are. Remember, you only get 50% of any meal when you take a client. You don’t get the hundred percent. And there’s no more entertainment expense.

Revenue:

Set some goals here. What are your goals for increasing revenue? Do you have a plan for that? Do you want to have the attorneys on staff set some goals? I recommend doing the monthly in having a staff meeting to see why they’re not meeting their goals. We want to stick to realistic goals or attainable goals here. Hard and fast numbers when you work with budgets.

Equipment:

Is your equipment getting on the older side and will need to be replaced? These tend to be one-time expenses, but you want to evaluate those as well.

Marketing:

How effective is the marketing that’s in place? Where are your customers finding you? Knowing where the clients are finding you should be part of your workflow, determining where the leads finding your firm. Where are your marketing efforts best served? Google ads? Facebook ads? Where is the money best spent?

The Dialog

Once you have this setup, now it’s time for the conversation. I just picked up a cool app, Collaboard. It’s a whiteboard/sticky note application. Schedule the meeting with the partners of the law firm owner and share the budget that you created. Open the door to conversation and write on sticky notes what they like or don’t like. What they think they need and what the partners think they need to reduce. The conversation doesn’t stop here. It should be a monthly, ongoing topic in staff meetings. Here is a link to that cool app we use in our practice called Collaboard.

Make sure you leave a little extra percentage in a category for over and under or a cushion account. As you are creating these for your attorney or Law firm client, you want to be sure that you get this as close to accurate as possible.

Talk to the client once you have completed the budget. Are they happy with it? Is it reasonable or is the client shooting for the moon? There is nothing wrong with being confident. For the past 2 years, I have set a goal that was to double my sales. The first year I made it. This year, I will miss that goal. You need to decide if you are that person who is okay with missing. Or do you need something more obtainable?

Implementing a Plan of Action

As you can see above, creating the budget is the easy part. Getting the client to sit down and have a conversation and be excited about it is the hard part. Having the right terminology may get you there if they’ve never had a budget or never had to think about the budget. This year is probably the best to have that conversation, even if their firm is doing well. I would argue that this is the best time to have that budget. Sometimes when there’s a lot of money in the checkbook, there is a desire to spend it. This is why the Profit First method or the new QB Capital pocket method works for some people.

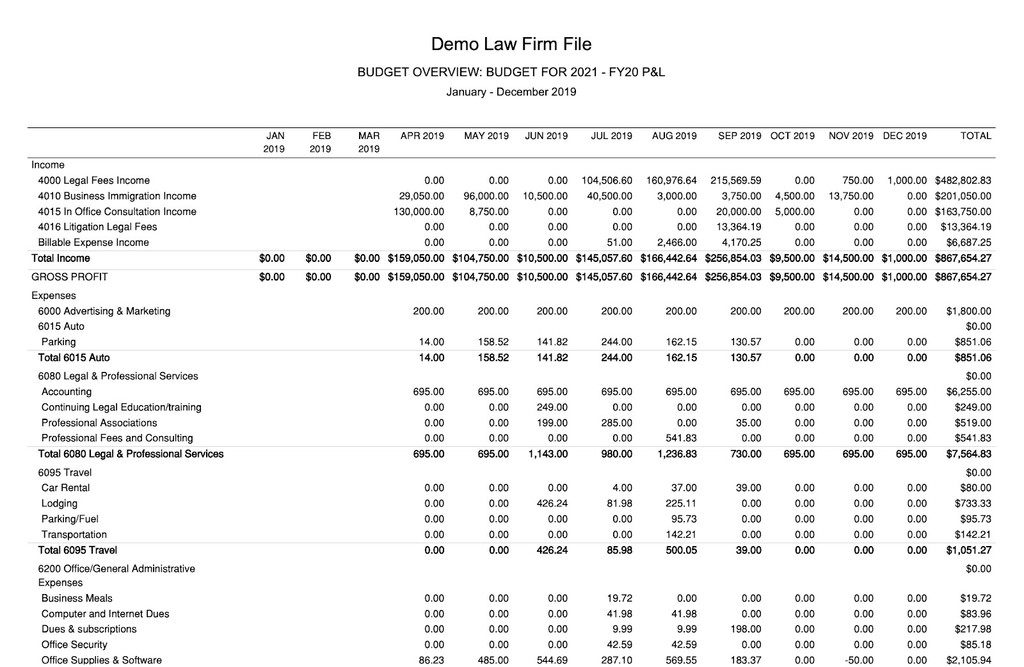

Lastly, create the budget, review it with the client. Let the client sleep on it and revisit it again in a week or so. Then tweak it. Your client will love you for this! Here is a sample of what a QuickBooks budget would look like.

It’s also a great time to discuss with them if there is a lot of money there, what strategy can we implement to mitigate some of the tax ramifications of having all that profit? Is it a good time to pay out some bonuses? Maybe replace some of that Asian equipment in 2020.

If you are an attorney in need of assistance with budgeting or accounting work, we are here to help you.