Legal Software: LeanLaw Settings Part 2

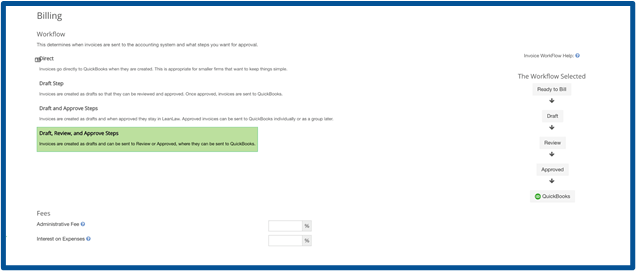

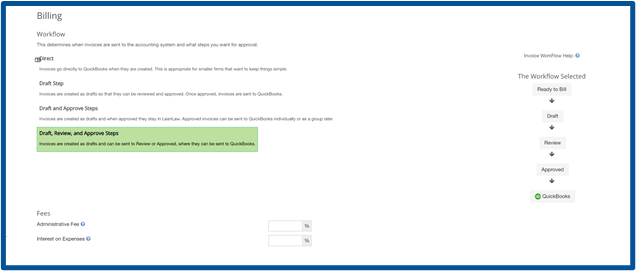

Considering that you've chosen to add LeanLaw as your attorney billing software, undoubtedly the main reason is because of the billing. You want a professional-looking invoice to send out to your clients. But more importantly, as an attorney, you do not want to miss any client costs or time billed. You want flexibility with the billing. For example, if you have staff - your admins, they can generate the draft invoices which you can review and approve before sending out through QuickBooks and your client.

LeanLaw is very customizable in the billing section. You get to choose what works best for your law firm. Are you a solo firm? Maybe bypass all the steps and have the invoice generated in one click.

Are you a small firm with an administrative assistant? Maybe you want the admin to produce the draft and you take it from there.

Or maybe you are a larger firm using an outsourced accounting firm, which is what we do. Then you will want all the steps from “Ready to Bill” to approvals.

Direct Selection: Ready to Bill

With the Ready to Bill step, under this tab will lie all the hours tracked and the expenses tagged to a specific client. Here is where you can filter down to the time period you are billing for and choose what will be invoiced to the client for the billing period.

If you are a solo attorney, you may want to select this choice so you can speedily produce your monthly invoices.

Draft Step: Ready to Bill + Draft

The ready to bill plus the draft step will include the ever crucial step of selecting your ready-to-bill choices and then reviewing them as they would be stated on an invoice. You will create a Pre-Bill. Having this selection will allow you to be flexible in changes and you can also write off directly from the draft step.

Smaller firms may want this extra step just to preview the bill before it goes to QuickBooks and the client. It is a great combination if you want to have a Timekeeper or Admin assisting in the billing process.

Draft, Review and Approve Stage

This is the whole enchilada! You go to ready to bill, create the draft, review and approve it and it will get processed through LeanLaw to QuickBooks. This is the workflow we use at our firm when working with our clients. It gives us the flexibility to have all eyes on the invoices from ready to bill to completion of the invoice.

Administrative fee on invoices

Some firms choose to charge an administrative fee along with the regular lawyer's fees which is included in an invoice. An admin fee is to bill the client for clerical work like managing the administrative tasks involved with handling clients. This could be things like answering phones, managing appointments, and reviewing contracts.

Interest on Expenses

In some states and jurisdictions for attorneys working on a contingency fee basis, they can charge a reasonable interest rate on unpaid funds advanced to a client.

If the attorney is going to charge interest on expenses, it is a best practice to follow these guidelines:

- The attorney-client agreement must describe the alternative methods of payment of such disbursements, explain the financial consequences of each, and clearly indicate the client’s selection.

- The attorney should be sure that the client is clearly advised, indicating what the interest charge is and will be imposed on disbursements that are not paid within a stated period of time, and the client consents to that arrangement before it goes into effect.

- The attorney agrees that the client will be billed for the disbursements promptly after they have been incurred so the client may decide whether to pay the disbursements or incur the interest charge.

- The period of time between the bill and interest charge is reasonable and the disbursement itself is appropriate.

As we move onto LEDES billing, you may wonder what is LEDES billing? I found a great description from Google:

“LEDES is a simple file format with specifications that support hourly billing, flat fee billing, expenses, multiple currencies, and tax. Created by the LEDES Oversight Committee (LOC) in 1995, this informal group of corporate legal departments, law firms, universities, and software vendors sought to address legal e-Billing software issues with a “standard format for the electronic exchange of billing and other information between corporations and law firms.”

If you have ever done LEDES billing it is far from the tenets that they originally intended, which are:

- Keep it simple.

- Make it unambiguous.

- Diverge from existing formats as little as absolutely necessary.

- Ask only for information the law firm is typically able to provide from their financial system.

- Meet the needs of corporations, law firms, and legal industry software vendors to the maximum extent possible consistent with the first four criteria.

With LeanLaw, these invoices must be created in the regular format and pushed into QuickBooks first before printing them in LEDES format. LeanLaw makes this process very simple. I plan on doing a full article on how we manage LEDES billing at our firm for our clients. Additionally, as mentioned in the video above, you need to be sure that you use that toggle switch to earmark the client/matter as a LEDES client, and as mentioned it is a good idea to set your codes and such in the file as well. I prefer to make the codes a requirement because that will save time in going back and forth with the attorney if any are missing. The programs that accept LEDES like Legal Tracker, will kick the invoice back if any of the details are missing.

Invoice Presentation Settings

I won’t go into too much detail about this topic as it is pretty self-explanatory. There is full transparency on how your invoice will be presented by just selecting the boxes or unselecting. There are Description and items, Summary and Structure categories.

Custom Fields

The power is truly behind the custom fields with LeanLaw. The most important aspect of custom fields is to create them in QuickBooks first and then make the connection in LeanLaw. Remember to only use the TEXT type of custom fields. Don’t get fancy here as they will not connect to LeanLaw if you do. Save those types of fields for data you only need to extract fromQuickBooks. Here are a few examples of custom fields we have used.

We hope that you found the information in this blog post to be useful. If you have any other questions or concerns about LeanLaw or other legal software, please feel free to contact us. We are experts and LeanLaw Accounting Pros.