Legal Software: LeanLaw Settings Part 1

As you dive into the software, you will get excited about the powerful one, two punch of LeanLaw and QuickBooks Online Advanced. QuickBooks is such a generalized accounting platform but what makes it the number one software is its integrations and its open ecosystem.

Note: these are settings in LeanLaw for the pro version, But they will also work for the lesser price version that doesn't have all the bells and whistles.

As I did the video for this article, I realized that this needs to be a multi-part series. This article is part one. What we're going to do is connect the software to QuickBooks and review some other settings in the setup.Firm name

Use the name that the company uses on front-facing invoicing.

Custom Fields

The custom fields section allows you to link fields in LeanLaw to fields in QuickBooks Online. The ability to create and link custom fields for invoices is probably one of the most powerful parts of this software. You can keep your client happy by customizing the system to give the client the fields they need. This is why layering QuickBooks Online Advanced with LeanLaw is the way to go with modernizing your law firm.

First you must set up the Custom Fields in QuickBooks Online Advanced

- Go to QuickBooks Online

- Click the gear icon (settings)

- Select Custom Fields from the Lists Column

- Select the green Add Field button

Note: You MUST only use the “text” field in order for custom fields to work in the LeanLaw custom fields. Any other type will NOT work.

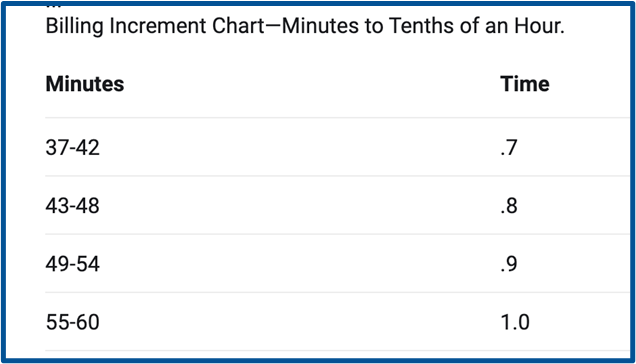

Time Settings: Rounding options

The default setting in LeanLaw rounds up time entries to the nearest tenth of an hour. However, in some jurisdictions, clock laws state to round to the nearest quarter of an hour. Be sure to check with your local bar association regarding the laws where you practice law.

LeanLaw has two settings

1. Tenth of an hour rounding: Most lawyers bill tasks in 6-minute increments. This is why the setting is set in LeanLaw by default. For tasks that take less time, they are rounded up to 6 minutes for billing purposes. For instance, a 3-minute telephone call is billed for 6 minutes of time. The 6-minute increment is the most common within the legal profession.

2. Quarter-hour rounding: With quarter-hour rounding enabled, time entries will round up to the nearest quarter hour for billing purposes.

- To enable quarter-hour rounding, navigate to firm settings

- Click the settings gear in the top right corner of LeanLaw.

- Left-hand side, find the link labeled “Firm Info”

- Mid-page, there is a default time entry Increment, you’ll see a green toggle switch with the values .1 and .25 on either side of it.

- While the green dot is on the left side, you’ll be rounding to the nearest tenth of an hour.

- Click the green toggle button to flip it to the right side to change the default settings.

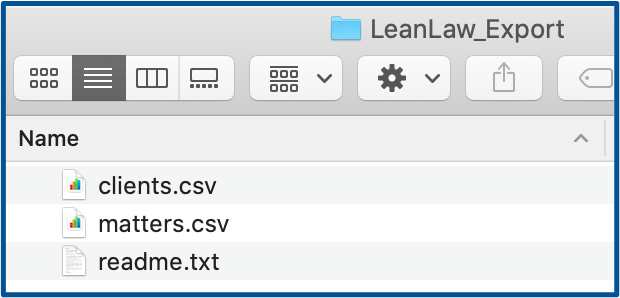

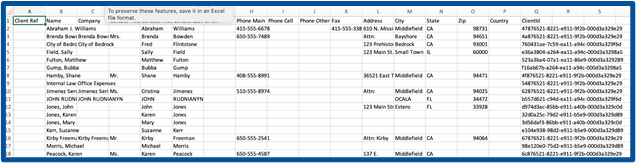

Download LeanLaw Data

LeanLaw has the ability for you to back up your clients, matters, rates, time entries, expenses, and fixed fees in individual Excel zip files. This feature is fast and gets the data out of LeanLaw quickly. Use this for your backup or if you are moving off the software. I love how it data dumps the details into several different files for you:

Subscription Choices

LeanLaw offers two subscriptions:

Core is currently $35/mo. You do get a discount if you pay annually which is $30/mo. You also get an additional discount if you go through a LeanLaw Po like me!

Pro is currently $50/mo. You do get a discount if you pay annually which is $45/mo. You also get an additional discount if you go through a LeanLaw Pro like me!

- Advanced User Roles (as mentioned in last week’s article)

- Custom Reporting

- Compensation Tracking

- LEDES Billing

- Custom Fields & Matter Based Accounting

Trust Accounting Settings

Chart of Accounts - It's crucial to have a great base if you're starting fresh. By far, the chart of accounts is the foundation of the law firm. One of the things that LeanLaw will do for you, is create accounts in the chart of accounts on the fly as part of the setup.

QuickBooks Integration

Click the gear on the top, right-hand corner, and that will bring you to settings. In settings, I want you to go all the way to the left side, where you see the word "QuickBooks." In QuickBooks, this is where you're going to connect LeanLaw with the accounting software.

The connection is relatively simple. You click to connect to QuickBooks and then navigate to your file. If you are an accounting firm, select your firm and then a sub-level of your clients will appear and you can connect the client.

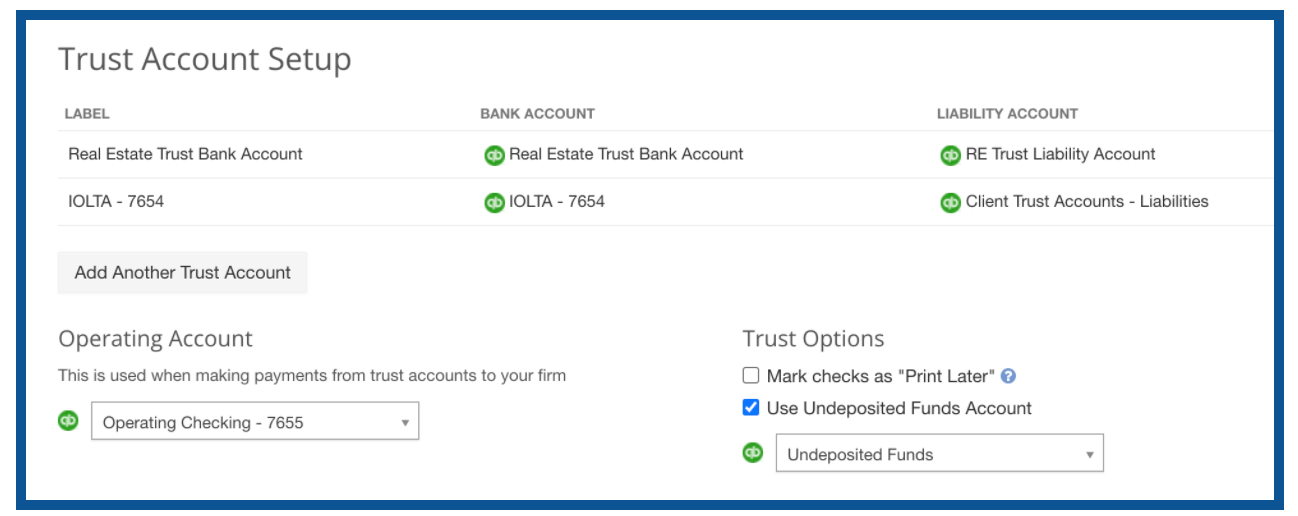

Linking the Trust Bank Accounts

Once a connection is made, you want to connect your trust bank account and your operating bank account to the system. You will need to decide if you want the system to be what I call “one-off” where each transaction of trust is a separate transaction or deposit. I prefer this method to undeposited funds where you group the transactions. It just is more succinct and more clear and provides for fewer data entry errors in trust accounting.

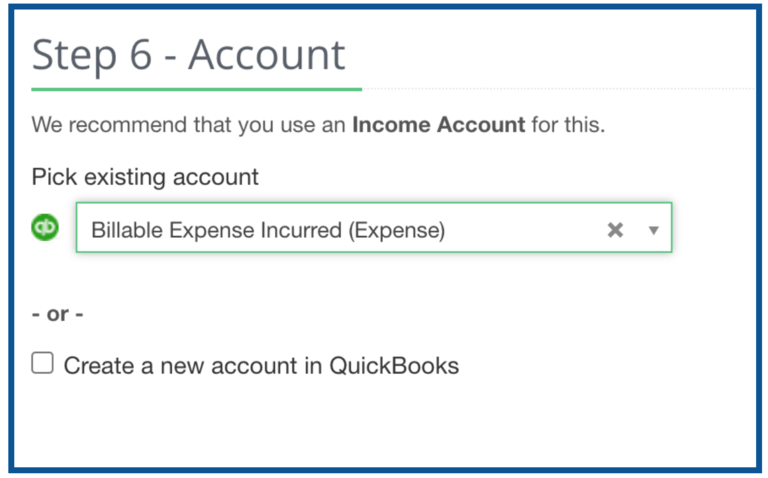

Connecting to the Income/Sales Account

You also will look at you creating some products and services in QuickBooks that will point to LeanLaw and be used in your invoicing.

Now, if you've been doing your books manually with only QuickBooks, this might seem a little restrictive. If you haven't done so, you need to have a product or service item that points to one income account. All of the legal software I've used thus far only connects to one income account. Why is that? Because the data tracking on the practice area is done in LeanLaw, not QuickBooks. This is where those reports will live.

So that might be a bit of a friction point if you've always had a parent|legal income account and sub-accounts for tracking the individual practice areas at your firm. You'll still be able to aggregate that data in the LeanLaw product, but it won't be in QuickBooks unless you manually push it using a re-class tool. Again, this is not a requirement unless you want to see parent income and sub-level/practice are income on the Profit and Loss report within QuickBooks Online.

For the product,/service, I have seen it named a few ways. You can call it hours, legal fees or you can call it whatever you like. How you name it is less important because the LeanLaw will tackle the invoice appearance to be professional and law firm specific. In a future article, we will get into the power of snippets and the new short-codes to save the data entry.

The most important takeaway is the item must point to the parent legal account, legal income or legal services.

Choosing Client or Matter Level billing:

By default, LeanLaw will invoice at the client level. This means that if you have multiple matters for a client, you can produce a single invoice with the matters, each represented on the invoice. If you are familiar with QuickBooks, this would be your customer: sub-customer view. One client with multiple matters would be invoiced with one invoice.

For matter-based billing, each matter will generate its own invoice. You can make this decision for the global usage for your firm but also know that this setting can be modified on an individual basis as well.

Billed with Parent Setting

This setting is so critical and magical all at the same time! Especially if you are matter billing. Why? Because let’s say that your client wants the law firm to send individual invoices per matter (matter billing). Then the client pays you with one check for multiple matters (client billing). This will allow you to enter that payment, apply it and clear the individual invoices that were paid.

Create Client/Matter Automatically from LeanLaw

This will automate the process and not require you to do this work manually. Create a client/matter in LeanLaw and it automatically creates a client/matter in QuickBooks.

ACH/Credit Card Setting

If you are using Quickbooks merchant services, you need this box checked. We have firms that only accept ACH and firms that accept ACH and credit cards. This will keep the setting checked off in QuickBooks for your invoicing. If you do not select this in LeanLaw, the setting in QuickBooks will NOT remain sticky and you will have to tick it off on each invoice manually. This is even if you have selected it on the Quickbooks side.

Gravity Legal

Stay compliant with receiving trust payments with. With Gravity Legal, the trust payment will deposit to the Trust bank account and any merchant fees will post to the Operating bank. It is integrated with LeanLaw. Highly recommend this integration as it makes sending a trust request to a client a breeze! You can even invoice the merchant fees to the client with Gravity Legal.

Expenses: Soft and Hard Costs

The next item or setup part of this that will be discussed in this article is setting up your expenses. I have a couple of articles on hard costs (or direct costs) and soft costs (or indirect costs). The setup is critical because it's going to help you determine how this looks on your books.

Remember LeanLaw works with the advanced client cost account. LeanLaw has a two-way sync. But if you're doing migration of past data or using the billable expense/billable income method, you need to determine what the changeover date will be to the Advanced Client Cost account method.

If you're starting in November, for example, you should continue with your current method for the remainder of the calendar year. And then begin using the advanced client cost method, the way LeanLaw was designed, as we advance in the new fiscal year. I like to include an account called "billable expense unrecovered” for any expenses you paid on behalf of a client and then never charged back to the client.

Connecting the Banking

Connecting the bank accounts can be very specific. If you have one or more operating accounts, you have to determine which operating account is going to be the recipient of the funds when money is moved from trust to operating.

When you connect the trust account or trust accounts, it's imperative that you create a sister liability account for each. I've seen people put them all under one trust liability parent account, but for ease of finding when there's a mistake if you have multiple trust accounts, it's best to create a separate sub-trust parent account per bank. Here's an example of how that would look:

- Wells Fargo trust checking #1234 (asset: bank account: checking)

- Client Funds held in trust: WF #1234 (liability account:trust liability)

- BBVA trust checking #5678 (asset: bank account: checking)

- Client Funds held in trust: BBVA #5678 (liability account:trust liability)

Believe me, this will save you a lot of pain and headaches when managing the trust account balance and you find it is incorrect. You will easily be able to target which bank account is off, and you'll be able to see all the liability accounts that equal that trust account balance.

That's it this week for part one of the settings and setting up LeanLaw for success! Next week we will continue our LeanLaw setup series.

If you are an attorney seeking help with your LeanLaw setup, reach out!