QuickBooks Online for Attorneys: Creating a Client, the Matter, and Receiving the Retainer

QuickBooks is a powerful tool for keeping your law firm running. This article will look at the basic setup of QuickBooks for law firms for creating a client, matter in the sales section, and also the client ledgers. QuickBooks setup for attorneys is very different than setting up for a typical company mostly due to the fact that they are paid upfront with a client deposit, better known as a retainer. This article will run through some of those setup items. This blog is for law firms or attorneys that need some of the basics on how to set up QuickBooks.

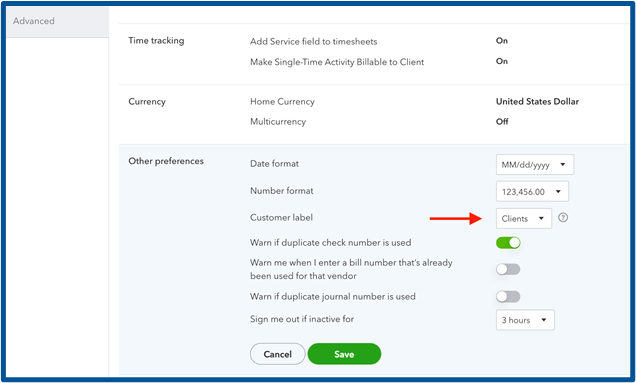

The steps for creating a client in QuickBooks are simple. One of the first steps I take is to change the language on the program to be a "client" from the current label, "customer." It's the language you use when you work with attorneys, and it makes logical sense to change that name. It's straightforward; you go to the gear on the top right corner and click on account and settings, click the advanced tab and then go down to other preferences at the bottom and change the customer label to read clients.

Create your Client in Sales

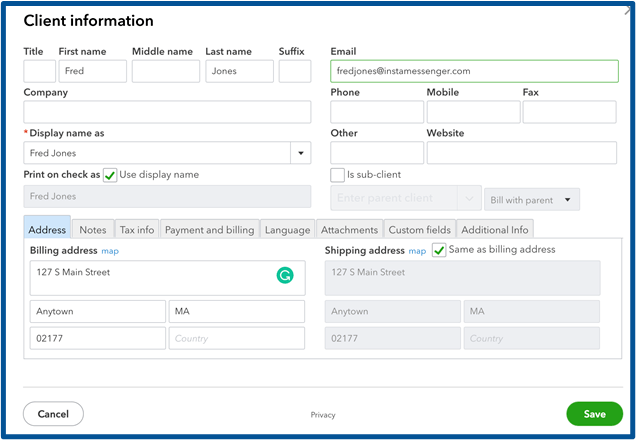

Now that your clients are appropriately named, you're going to click on the sales tab on the left. Then click the tab called clients that'll be near the top center. The first step to enter a client retainer received is to create the client.

- Click the green new client button.

- Fill in the client's name.

- Fill out all the other details that pertain to the client, like their address or email phone number and any further information.

Once you have your client set up, you're now going to enter that ever-important upfront deposit, better known as a retainer. To enter the retainer, you need to create a trust account for this specific client and matter.

Create the Client Ledger and Matter

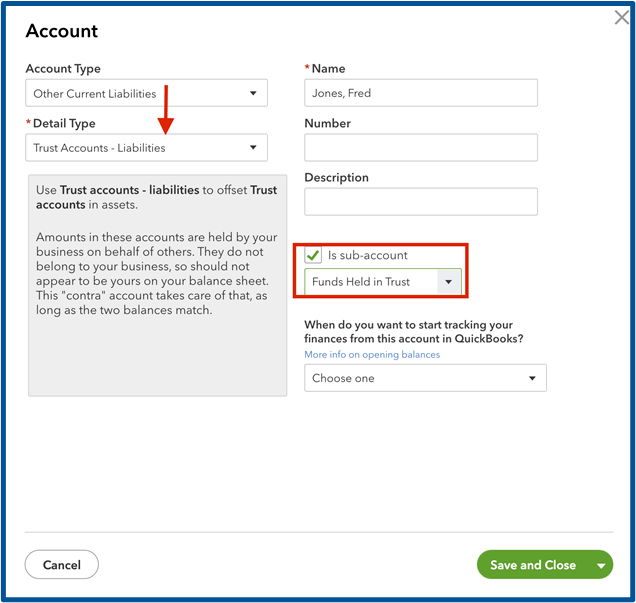

To create the sub-client in the sub-client matter, you will go to the accounting tab on the left navigation bar, click chart of accounts, click new:

- Account type: current liability

- Detail type: trust account liability

- Name: Put in the name of the client

- Make it a sub-account under the trust liability parent account.

To make the matter, follow all of the steps above, but for Name: Name of the matter, i.e., divorce, and then make this account a sub-account of the client trust liability account you just created.

Now that you have performed all of the items you need for setup, you will need to record the retainer received. That's a simple transaction that can be done using a sales receipt. You can also record this transaction by using an invoice and a customer payment. The choice is made for sales receipt if the client comes into the law firm, becomes a law firm customer, and pays on the spot. If a client is paying later, you will use the invoice/customer payment functionality.

Create the Product

Next up is the products used in the sales transactions. I create two:

- Retainers received.

- Retainer applied.

For both of these products, you want to connect them to the trust liability header account.

Ensure you use the proper language to your advantage and enter a generic description that can be used repetitively for the retainer received and the retainer applied product. It is a service type of product, and in most jurisdictions, it is not taxable. Be sure to check with your local Department of Revenue to find out if legal services are taxed.

Creating an invoice is simple. You're going to go back to your customer named Fred Jones, and once you're on his name, you will click the green bar that says new transaction. Choose the retainer received product.

For the sales receipt, the entire transaction is located inside the form. For the invoice, you have to receive the payment and then make the deposit.

The next step is to move that retainer to the proper sub-client account matter. Moving the retainer is done via a journal entry. You would debit the trust parent liability account in credit the trust header to properly allocate the funds.

My Professional Recommendation

Can you use QuickBooks Online for a standalone for attorneys? The answer is yes…. and no. Using QuickBooks without external legal software depends on the practice area of the firm. Yes, if you are a firm that bills with subscriptions or fixed fees. No, if you are tracking trusts and time to bill back to the clients.

You can use QuickBooks for law firms without external software, but you will have to do many manual processes. Always remember that anytime you've begun to do a lot of manual entry, you will be opening the door to the chance of errors or hours or expenses not billed. If your hourly rate is $250 an hour and you miss invoicing a client for that time, that will pay for your legal billing software.In Closing

These are the steps for setting up the client in QuickBooks and receiving a client retainer. QuickBooks is a very useful tool for law firms. With QuickBooks, you can keep track of your clients, your matters, and your finances. You can also use QuickBooks to produce invoices, manage payments, generate reports, and much more. If you have any questions, feel free to contact us at: