QuickBooks Online for Attorneys: Entering Billable Time and Expenses

Congratulations on your decision to use QuickBooks Online! It is a robust accounting software. You've probably already realized that it is not built just for attorneys or the legal industry. It's software that's customizable to any industry. You need to know the finite steps to customize the program to work for you.

Which Version of QuickBooks has Billable Functionality?

The billable functionality is why you cannot use the Simple Start or the Essentials version of QuickBooks Online, as it does not allow for tracking transactions as billable. Only the Plus version or Advanced versions have the billable feature.

If you have googled me, you have probably heard me on YouTube videos and social media that my preferred version is QuickBooks Online Advanced. It has all the bells and whistle's that you would need to track, including custom user roles, workflows, and, of course, custom fields. It allows us to tailor the software to your practice area completely.

If you are interested in getting special pricing directly from me, reach out at [email protected]

Setting the System Up to Use the Billable Function

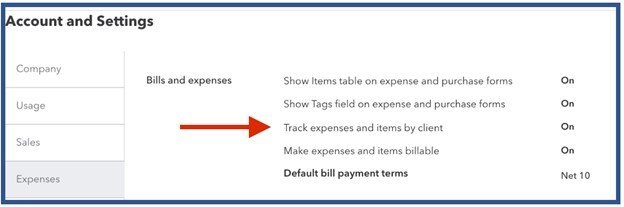

You have to be sure that you've set this up in the system under accounting preferences to tracking items as billable as it is set to off by default:

Turning on the Billable Function

- Go to the gear, which is for your default settings.

- Go to account and settings.

- Go to expenses.

- Under the section, bills and expenses, click the pencil to edit.

- Click the box to track bills and expenses as billable.

Using Advanced Client Costs Account or Billable Expenses and Income Account.

There are generally two types of workflow around direct costs. It depends on your preferred workflow. If you use the client advanced costs account, make a product/service item for that category but make it a two-sided product/service. So the same item is used for the income and expense side and booked to the same account. The workflow is an in and out transaction through the asset account.

Recording a Time Activity

For the time entries, you'll need to have software or a device. (think your cell phone) to track the time. Toggl is one of them, and it has a pretty good free option. There's also Harvest, but there's a limitation to two open matters. Of course, you can also use your iPhone to track your time and a good old spreadsheet to keep the listing.

Create the Employees

Even if you are a solo attorney, you'll need to set yourself up in QuickBooks as an employee to track this manual time. It's an "only for this purpose reason," so don't worry about that setting. But you'll need to be an employee to access that name under the manual timesheet section.

Time Sheets

Once you've tracked your time, you'll go to the +, where your transactions live, and enter manual time entries per client. Follow these steps:

- + single time activity.

- Click the billable box.

- Enter the employee, which is the attorney of record.

- Enter the time or the start/stop times.

- Enter the description--this is a crucial step as this will translate onto the invoice.

For attorneys, the steps to track time and expenses in QuickBooks are the same as for any business. However, the legal industry has specific needs that may differ from other companies. You can learn more about QuickBooks for legal businesses by watching the video below. I walk you through these steps outlined above. The very last step to invoice this billable time and expenses is just a matter of clicking +New > invoice to open a new invoice and add the billable time and expenses to the client' invoice. It may seem like a few steps to produce this but it will result in proper accounting in your records.

If you are an attorney and need help setting up QuickBooks or ordering a new QBO file, reach out to me. I can get you a great discount on the software.