QuickBooks Online for Attorneys: Getting Started with a Chart of Accounts

Welcome to a series on how to use QuickBooks Online for attorneys and law firms.

A chart of accounts is a very important aspect of the accounting system for a legal entity. You need to make sure that you have the right chart of accounts as it directly affects the way you manage your accounting. This blog post will go over how to import the chart of accounts from an Excel spreadsheet and have the right legal-specific chart of accounts that is ready to use.

In this scenario, we have assumed you decided to use QuickBooks Online. It is a tremendously powerful accounting software and a fantastic tool for getting the essential metrics that you will need to grow your firm profitably.

If you have not purchased QuickBooks just yet and you're still in the mode of deciding, click here to get the best deal on the QuickBooks software. We currently as of this blog post, can offer Advanced for $67/mo. for 12 mos.

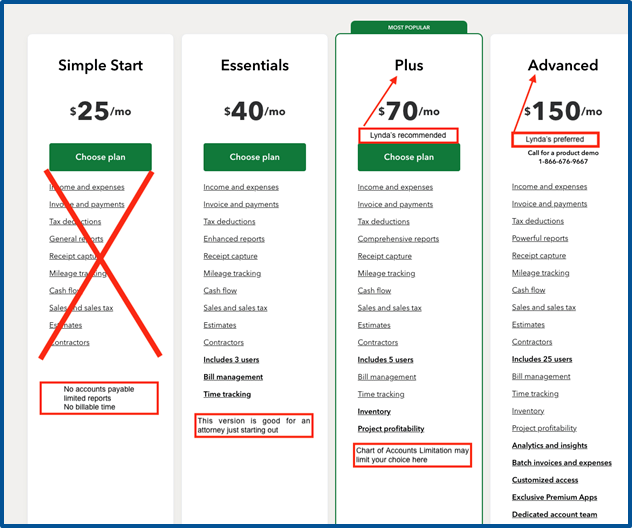

Here is what you will see when deciding what version of Quickbooks you would like. Take note of the different services under each plan and my overall recommendations.

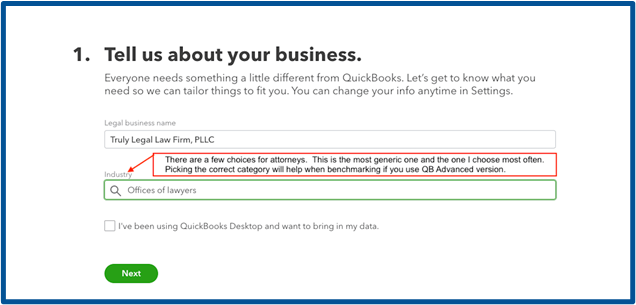

After you login and create your user, you will see the welcome screen:

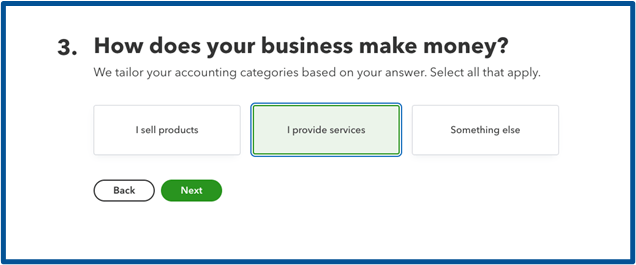

The first step you'll have to answer a few questions to get by the little survey. Here's what I recommend as the answers:

Entering a law specific chart of accounts

The left toolbar is your hub for working in QuickBooks. You'll see some hot links and the plus new sign, which is where you'll get to use it for all your transaction work. Click on the accounting tab to get direct access to the chart of accounts.

When you sign up for QuickBooks Online, you get a default chart of accounts. Unfortunately, many of these accounts need to be turned off because they are not anything that a law firm would ever use, like "purchases" and "job supplies. "This minor cleanup is essential for a clean and proper import of a law-specific chart of accounts.

When we work with our clients, many of which are in larger firms, we have a process where we will put their current chart of accounts on a Google sheet. On a 2nd tab we will add a chart of accounts that we recommend and then on a third tab we call "blended" which is the tab where we will take our preferred and combine it with what the client needs from their current chart of accounts along with any special accounts specific to their practice area. The last step is when we meet with our client on zoom and finalize the chart of accounts and have the client sign off on the last tab, which will be our approval page.

Fine tune the details

When starting with a fresh and clean file, this is the first step. Putting those details in at the beginning will set you up for success. If you are working at a larger firm or have a need to track multiple partners, do you want to turn on the class tracking? If there are numerous locations for the law firm, you'll want to track the data by location.

If you have multiple practice areas, you want to track the practice areas under the legal income parent account. When you subcategorize this way, you can follow the influx of income to determine revenue by practice area.

Multiple Trust Account Method

Another area of concern where I see problems in files that come to me from customers is multiple trust accounts. For example, there may have been a trust account from the past that is still open, or you may need a separate trust account for real estate or another area that you have to have that separate accounting. The easiest way to track this in QuickBooks is to make a parent account called trust accounts and subcategorize the individual trust bank accounts. I also will do this for the operating bank accounts. This gives the bank accounts separation, but it also will provide you with visibility in banking as a whole.

When tracking trust accounts, it's not a bad idea if you have multiple bank accounts or trust to have multiple parent accounts for funds held in trust. As you can see in my example, we have two separate bank accounts. So I'll have two different client ledger parent accounts. That way, I can collapse them to see the totals when it's time to do the three-way bank reconciliation.

These are just a few tips, and in the video, I demonstrate how to import a chart of accounts. It's a simple process. You download the template that is in every QuickBooks file. The template is specifically designed for the import process. Then, with just a few clicks, you can import the entire listing to your file.

Next Week

We will dive into importing a listing of client ledger as if you're starting a new company file from an old file and you want to bring only the active accounts over. It's a simple process and similar to importing the chart of accounts.

We hope you enjoyed this post about how to import a legal-specific chart of accounts. We also hope that you have been able to use the information in this blog post to successfully import your chart of accounts into your QuickBooks Online accounting software. If you have any other questions or concerns about importing your chart of accounts, please contact us anytime at: