The Attorney Balancing Act: Correcting Trust Account Mistakes

When I think of balance, I always think of my yoga practice. When you work with attorneys and live in a world of compliance, you know that balancing one or two or even three trust accounts is no easy feat.

There are many reasons why trust accounts become unbalanced. Here are a few:

- The attorneys keeping track of these individual trust ledgers are in a spreadsheet, which is manual entry.

- The lawyer is using software that's external and not integrated with the accounting platform.

- The trust account hasn't been balanced because the law firm thinks it's balanced because they use QuickBooks, and it is connected to the bank feeds.

So how do you figure out where to start and how to fix it at your law firm?

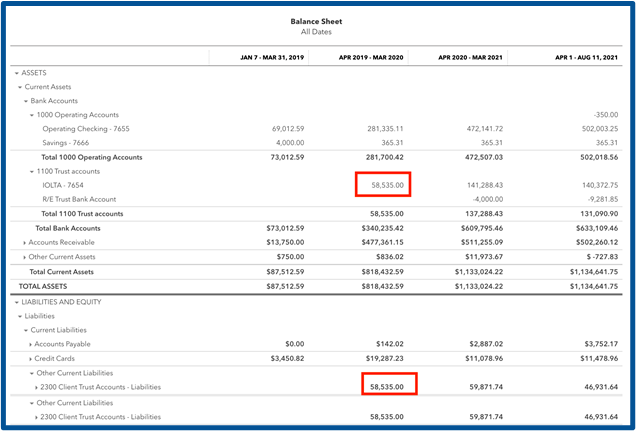

- You need to find a good clean starting point, and that may be when you opened the IOLTA or trust bank account. Yes, you might have to go back to the beginning. I can tell you, from my experience, that going backwards is never very easy. My first suggestion is to open up your balance sheet report in your accounting software and change the date range to "all dates". If you are using QuickBooks, group or total the report by year. Search for where the bank account and the trust liability account match.

- If you're using the method of individual trust liability accounts under one single parent account, collapse that column and see if the total of the liability accounts equals the bank balance. If it does at some point, that's where your starting point is. That's when your account was balanced.

- If you find that “sweet spot”, you have external software that's not connected, you'll need to run a separate report in the same format and try to see if the amounts align.

- If you find a year where the trust bank and the trust liability account(s) balance, you can expand the following year and see what month the balances went awry. That will be your starting point.

From there, it's a matter of going month over month and seeing where the individual balance is off.

The following are typical reasons we find that the bank trust account doesn't align with the monies in the individual client ledger's:

- In the external software, the attorney creates the invoice and applies the payment but never moves the funds at the bank level.

- The trust monies received were deposited inadvertently into the firm's operating bank account.

- There are a lot of outstanding checks or deposits that never cleared the bank in the trust account. Outstanding checks happen, but they need to be tended to monthly. As checks are sent out, you should follow up if the client doesn't cash a return of retainer. I've seen some bank accounts that go back five or ten years where there are just the stale checks hanging and never cleared.

- They were both duplicate entries made for the same trust transactions.

You have to put on your super-sleuth hat, grab that magnifying glass and go for it. It's never easy, and many times, it's time-consuming to locate where the errors are. Once we find the errors, we can see patterns that make that trust clean up a little quicker.

So, does all of this sound daunting to you? If it does, my best suggestion if you are an attorney or work at a law firm, is to call us. Cleaning up messy trust accounting is the work we do day in and day out. We love it!