Using Tags in QuickBooks for tracking 1099s

We had a lively discussion in our Accountant’s Law Lab group last week. The Law Lab is a group of accountants and bookkeepers who may have one attorney-client or multiple, and we discuss all things legal accounting. If you’re not a member and you work with attorneys, you should join us.

Prepare for the Season

The discussion of 1099s came up because we want to be prepared for the rush in January and February. It is essential to be aware that when doing 1099 processing there are two forms. There’s 1099 NEC, with a deadline of January 31, 2022, and 1099 MISC, with a deadline of February 28, 2022. If you work with attorneys and law firms, you might be using both of these forms.

You may be asking yourself, “why would I want to use tags when I can just make a vendor a 1099 contractor by editing the vendor and checking the box for 1099‘s?” While this is true, you need to start somewhere. I wish there were a way to see if a vendor on the list was set, especially if this is a new client to you or a client that you picked up this year and did not even consider the 1099 list up for 1099s. Unfortunately, you have to dig into the vendor card itself to see that. There is no high-level visibility. Enter tagging.

Tags in QuickBooks

By using tags, this method can help you quickly tag a vendor as 1099 NEC or 1099 MISC. You set up your tag group like this:

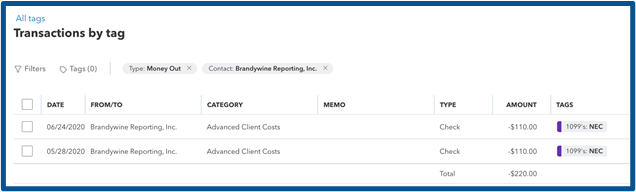

Next, you run a transaction by vendor list. Group it by the vendor to see the list of possible vendors. Then go to the tagging section, run the untagged report, and filter it by vendor and money out transactions to quickly tag all transactions for the calendar year.

This process is beneficial if you’re not using QuickBooks for 1099 processing and using another service. Yes, there are reports within QuickBooks that will give you those lists once the vendors are set up. But if you have to track many vendor transactions quickly, this works very well. Because of the tagging, you can go into the banking tag screen and filter it by money out and vendors. Here you can tag them as NEC or MISC. The high-level view of 1099 ready vendors is a functionality that’s not within the QuickBooks 1099 feature. Being able to run a report by NEC and MISC will help you to process them more efficiently.

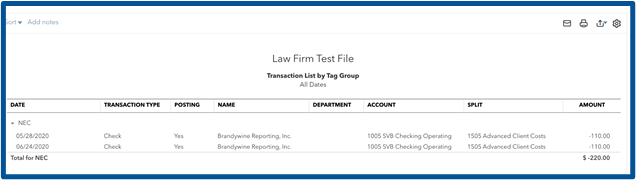

Once all the tagging is complete, run a report Transaction list by tag group to get a high-level view of who you think should get a 1099 and you can send this report to your client for review.

If you are using QBO for processing 1099’s, you can go into each vendor to mark them as a 1099 vendor and enter their tax ID. If you don’t have the ID, you can send the vendor the W9 and start collecting that data. Once all the transactions are tagged, you can run a profit and loss by tag report to quickly see which vendor needs a 1099 NEC or MISC.

We all get busy in January. Why not bring that jump start on the 1099 process now?

Are you an attorney that needs help with this process or accounting in general? Contact us.