Year End Processes Balance Sheet

Closing out the books for your law firm client with QuickBooks is a topic I thought would be timely to explore.

There are a few things I like to do at year-end for my clients, just to get their files tidied up. Next month tends to be the season for the cleanup jobs. So, I want to have my current clients’ files ready.

Since we are just beginning the new year, it can get crazy trying to jam everything into a couple of shortened work weeks. Time will fly by. Now is a wonderful time to review the client’s entire file for the year.

Books Review

In December, we dove into the book review feature. I won’t go into detail on this again. You can click here to access the blog from last week. I would definitely recommend starting in the books review section with this functionality in QuickBooks.

Review the Balance Sheet

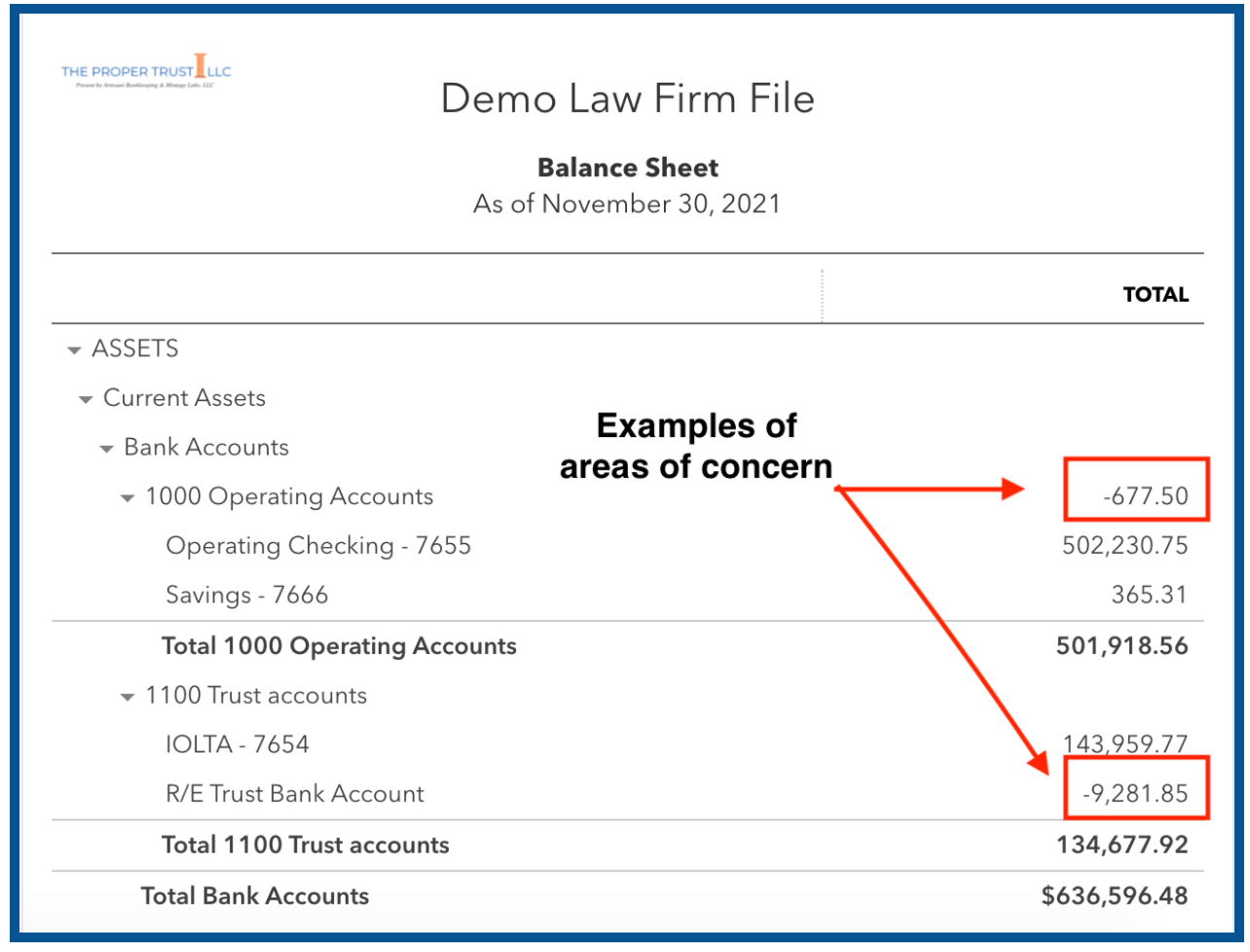

Review your accounts, looking for anything that seems to be in the wrong column. What I mean by that is if you are looking at an asset with a credit balance or a liability with a debit balance, something is probably wrong. You will also see them with a negative balance. Unusual balances are generally a red flag that something is not right.

Review the Payroll Liability Accounts

Drill down on your payroll accounts. Check the balances. If you’re using QuickBooks Full Service payroll, the balances should be accurate, but you should verify them. I recently saw a client file that had a different payroll service last year and moved to QuickBooks Online Full Service payroll this year. There was a balance that was leftover from the prior tax period that was paid in the current fiscal year. That balance had nothing to do with this year’s payroll balances. You want to expand the category and look to see that totals zero out every month. If you have an odd balance that just keeps lingering, you need to take a look at it and figure out what’s wrong. Use the payroll reports and tax returns to validate the numbers.

Assets/Depreciation and Prepaid accounts

Assets: If you’ve been entering your own depreciation, look at these balances too. I have seen where people do their own depreciation by memorizing what the accountant has recorded in past years. They memorize it to continue on forever. You will see a negative asset balance if the asset's life is gone. Again, the guidance of your tax professional is key. If you have last year’s tax return, you can tie the books to the tax return.

Prepaid Accounts: You pay for your insurance bill in several large payments. Your insurance policy period could run other than the calendar or fiscal year. You need to divide that total insurance bill by 12 months and then make a journal entry to expense it monthly. I often see where a customer just enters the whole amount into the insurance expense category. Their insurance may run from 8/1/18 to 8/1/19, so you cannot expense the entire payment in 2018 since 8 of the months are for the 2021 fiscal year. Note, if they are doing their books on a cash basis, then they will be expensing the entire amount for the year it was paid.

Reconciling: Your customer deposit account for any unearned income is also a MUST. Reconciling your IOLTA or Trust Liability should be happening every month. A proper 3-way bank reconciliation is REQUIRED.

Loans or Mortgages and Credit Card balances

Loans: People tend to enter the entire loan payment into the loan account (liability) and not expense the interest on the account. Look to see if you have properly broken out your loan payments. You should see several line items on a loan payment check entry: loan account, interest expense, and escrow if applicable. Remember, a loan is NEVER an expense, just the interest portion. Reconcile this account too for accuracy. For the final month of the year, I attach the loan statement that ties to the year-end balance so the accounting professional can access these important documents.

Credit Card Balances: Here’s one I see quite often. You can refer to this other article about ensuring that credit card account balances look accurate. If you have sub-accounts and you reconcile the parent account, the total may be correct, but the balances may be off. You need to be sure that you break out the payments by sub-account.

That is just the beginning of my process. Stay tuned to Part 2 of closing a client file at year-end.