Reconciling the Advanced Client Cost Account

Reconciling the advanced client cost account is a must if you do attorney bookkeeping. It is important to track this account. If it is left untouched, you could be leaving important transactions that should be billed back to the client or expenses that should become the firm's expenses in the wrong account. Reconciliation is the only way to be sure you are tracking all of these important transactions to the right account.

I recently had a question from someone who had seen me on the QuickBooks Power Hour Niche Nuance episode. The question was, "How do you reconcile the Advanced Client Cost account? It's a great question. I've formulated a method for this within QuickBooks.

The Method

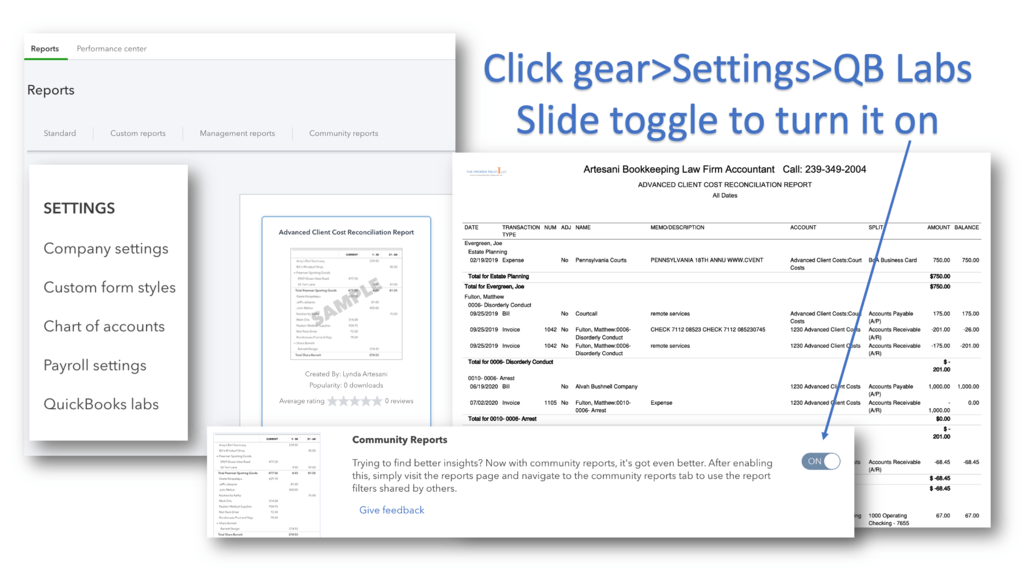

Note: You have to turn that feature on in Settings (gear) > QuickBooks Labs> Community Reports as depicted to the left. Like all "new" or "beta" features, it worked but you had to pick the distribution account. In my test, it defaulted to accumulated depreciation account, my top listed asset.

In my test of a client's file, you must click customize and select the Advanced Client Cost account for your firm and where it is located on the balance sheet. Then remember to save it as your own custom report.

Creating the Report

It's a simple report to create.

- Click on reports in QuickBooks (left toolbar)

- Click on the balance sheet, and make sure it's on an accrual basis.

- The report needs to be “all dates”.

- Next, you will click on the advanced client cost account. That will open up another window and expand that account.

- Sort or group that account by the client or customer name, which will resort to the list and put all client transactions together. You are going to see the ins and outs of each client account. All the zero balance ones will need to be cleared in the reconciliation process.

- Click customize and select filter>cleared>uncleared. This will allow you to view the report with the cleared transactions removed.

Reconciling

The beginning balance on this account will be zero, and the ending balance will be zero. You will clear off the pluses and minuses on all the net zero balance ones from the report above to see what's left over.

If you're not using LeanLaw this will give you a birdseye view of what is in your ready-to-bill billed expense category or WIP (Work in Process) expenses.

When you are done, you will see what is still hanging, unbilled. You can quickly go through this account and observe where there is an open balance hanging. Those are the pesky transactions you need to address. Are they meant to be left in the unbilled/WIP status? Or do they need to be moved to a firm expense?

If they need to be removed, the best method is to do a journal entry. Enter a transaction to debit the Advanced Client Cost account and credit Billable Expenses. Make sure to clear the transactions in the next reconciliation of the Advanced Client Cost account.

Now, if you're using LeanLaw, (which why aren't you?), you can compare this to the expenses tab to see what's open and available to be billed, which is your expenses side of Work In Process. If all of the transactions are processed properly, you will see the same totals after you are done reconciling in the expenses tab in LeanLaw and in the unreconciled in QuickBooks.

Important Note:

If you do use LeanLaw and you enter an expense/check/transaction and code it to Advanced Client Cost Account in QuickBooks, it will push into LeanLaw with its two-way sync. If you change a transaction in QuickBooks from the Advanced Client Cost account or if you follow the steps above to reconcile the transaction away in QuickBooks, it will still be in LeanLaw as an expense in billing (WIP) even after you clear it from the QuickBooks program.

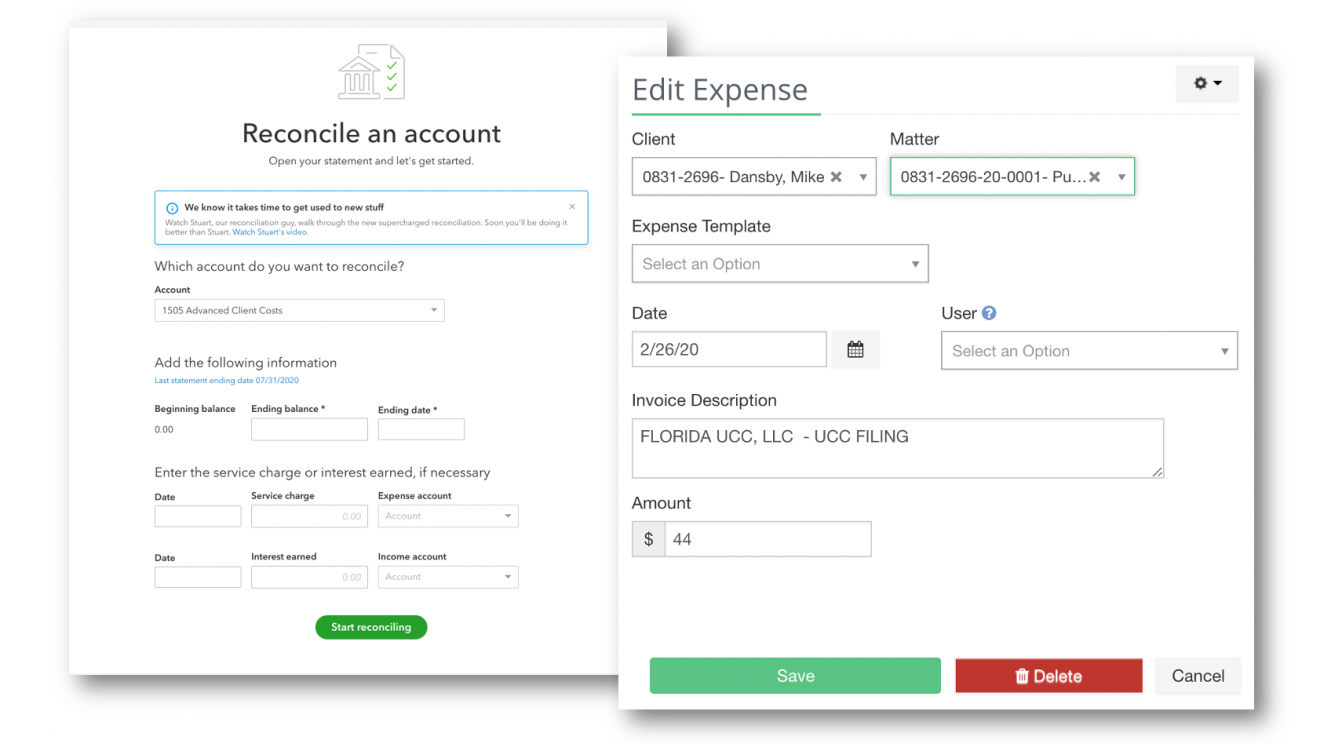

You will have to log into LeanLaw and open these expenses to expand them like the photo above and click delete to remove them entirely from the LeanLaw program.

If you're curious about the three-way reconciliation, that has to do with the IOLTA account. See this post for more information.